Where In-House and Outsourced Logistics Collide

Welcome to the 67th edition of The LogTech Letter, a weekly look at the impact technology is having on the world of global and domestic logistics. Two weeks ago, I looked at whether the shipping industry had done enough to combat carbon emissions the past two decades. This week, I’m giving some historical context to moves by retailers to buy 3PLs and asset-based providers.

As a reminder, this is the place to turn on Fridays for quick reflection on a dynamic, software category, or specific company that’s on my mind. You’ll also find a collection of links to stories, videos and podcasts from me, my colleagues at the Journal of Commerce, and other analysis I find interesting.

For those that don’t know me, I’m Eric Johnson, senior technology editor at the Journal of Commerce and JOC.com. I can be reached at eric.johnson@ihsmarkit.com or on Twitter at @LogTechEric.

My colleague Ari Ashe this week broke the story of Ashley Furniture buying Wilson Logistics, a truckload carrier and intermodal marketing company. It came just weeks after American Eagle Outfitters acquired Quiet Logistics. The two moves can be seen on one level as retailers seeking to gain more control over a part of their supply chains where costs have spiraled out of control and where access to capacity has become constrained.

It’s a natural move toward horizontal and vertical integration that is happening all over the place in logistics these days, whether its Maersk buying a range of forwarding, fulfillment, customer brokers and even fast fashion assets, or DP World and PSA International buying logistics providers or feeder container lines.

But vertical integration is no new phenomenon. Whereas once the overarching goal was to replicate the controlled network of integrators like UPS and FedEx, now the goal seems to be to mimic as much as they can the end-to-end customer relationship control of Amazon. An adjacent desire is to take a cost center and turn it into a revenue stream.

But let’s narrow in specifically on what Ashely and American Eagle have done and place their moves in a historical context. A decade ago, when Walmart was the retail industry’s invincible boogieman, some well paid consultants theorized that Walmart could turn its internal prowess in supply chain into a flourishing business unit of its own. This was particularly the case around warehousing, where the idea was that other shippers (even rival retailers) would sign up to allow Walmart to handle some aspect of their contract logistics. It was not a core strength of those shippers and it was a core strength of Walmart, so why not down weapons and leverage economies of scale?

The past decade evolved in such a way that this never really took root. For one, contract logistics providers evolved, technology progressed to underpin new warehousing and fulfillment networks, and, of course, Amazon took a strong interest in directly controlling logistics. What’s changed? What has made retailers with a decidedly smaller footprint than Walmart decide to invest in logistics and asset-based providers?

This crazytown market has changed. The cost of freight went from afterthought to bright red line item. E-commerce went from a curiosity to the preferred channel for retail. Shipment sizes have shrunk, volumes have grown, cost differentials between modes have decreased, new modal options have emerged. All these dynamics would ordinarily require a shipper to go from taking more control of their logistics management activities to looking to 3PLs to help them manage the new world. Well, the next step is to essentially gain control by taking the 3PL in-house, not just the functions that a 3PL would manage.

That’s what keeps the logistics industry interesting. The cycles repeat, but they do so in an outside environment that is changing. So a software idea that was good in 2000 but never got adoption because the technology environment wasn’t advanced enough might be great in 2010. A strategic concept first conceived in 2010 might finally get traction in 2021 when the market dynamics make it more necessary.

Here’s a roundup of recent pieces on JOC.com from my colleagues and myself (note: there is a paywall):

Much has been written about how carriers have unduly profited from the chaos of 2021, but not much has been written about what happens next. So I took a crack at just that, with the help of some financial data from AlixPartners and conversations with a dozen industry watchers. This one is a hefty read with a lot of charts, but it’s critical to think about whether carriers will use their profits to pay down debt, reward shareholders, dive into M&A, or invest to serve customer better, including with tech.

There has been no end to the number of mooted solutions for the port congestion in LA/LB, but let’s boil this down to basics. Southern California is awash in empty containers (both inside and outside port terminals) and yet drayage providers struggle to get access to appointments to return empties. Part of the problem is that most terminals have their own systems and processes. I wrote this week about BlueCargo, whose approach to aggregating available appointments, has found the perfect environment for traction.

It’s not quite unicorn territory…yet…but CloudTrucks’ $115 million round from Tiger Global and others puts it pretty close. I’ve been covering the universe of technology enabling small fleets and independent drivers for a while, and let’s just say, it ain’t slowing down any time soon.

And here are some recent discussions, reports, and analysis I found interesting:

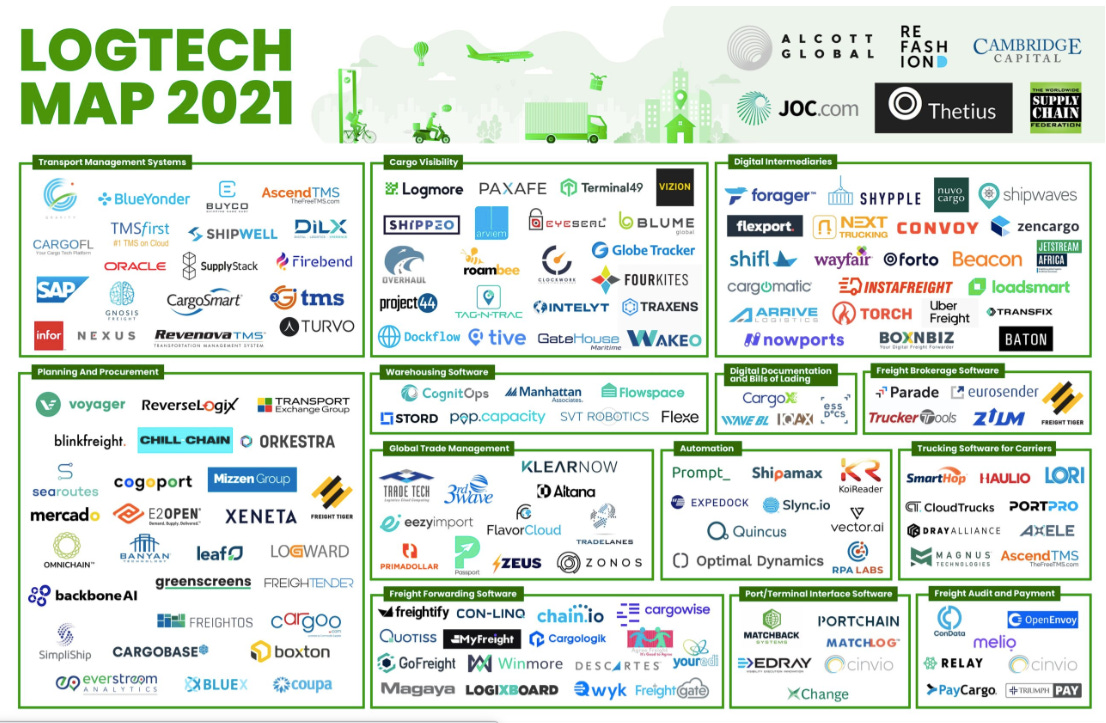

Last week, we finally, mercifully released the final version of our LogTech Map. This has been a rewarding, but exhausting initiative. Our hope is that people find value in this as a piece of their investment decision-making puzzle.

A worthy read on the digitization of shipping documents, drilling down specifically into the eBL.

Is this a model for how container lines will view contracting with customers? Time will tell.

Great chat between DAT’s Chris Caplice and Erin Van Zeeland of Schneider here.

What impact does import/export activity have on public companies’ financial performance? My IHS Markit colleagues took a look.

Be sure to catch the on-demand version of this IHS Markit webcast on the supply chain outlook for 2022, which has insights from a bunch of our rockstar experts, including JOC’s Peter Tirschwell.

If you missed my chat earlier Friday with Jett McCandless, CEO of project44, you’re going to want to catch the on-demand version here. We talked about a lot, including why he’s so public with p44’s financials, what to know about VCs in logistics, and why he’s not worried about a stream of new logos popping up in the visibility space. As always, subscribe here to LogTech Live on the Let’s Talk Supply Chain Network. The next show is at 10 am ET Jan. 7.

Disclaimer: This newsletter is in no way affiliated with The Journal of Commerce or IHS Markit, and any opinions are mine only.