The Rise of the Founder/Investor

Welcome to the 71st edition of The LogTech Letter, and the last of a long 2021. TLL is a weekly look at the impact technology is having on the world of global and domestic logistics. Last week, I took on the dicey topic of “cartels” in the liner shipping industry. This week is a two-parter: exploring the growing role of LogTech founders as investors back into the logistics ecosystem; and a look back at ‘21/look ahead to ‘22.

As a reminder, this is the place to turn on Fridays for quick reflection on a dynamic, software category, or specific company that’s on my mind. You’ll also find a collection of links to stories, videos and podcasts from me, my colleagues at the Journal of Commerce, and other analysis I find interesting.

For those that don’t know me, I’m Eric Johnson, senior technology editor at the Journal of Commerce and JOC.com. I can be reached at eric.johnson@ihsmarkit.com or on Twitter at @LogTechEric.

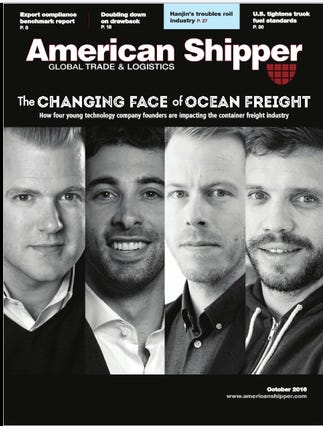

Even as I’ve spent a considerable amount of time the past five years exploring the impact of venture capital on the world of logistics (the OGs may remember this cover from fall ‘16)…

…I always feel a step behind. The VC world moves so fast that when I step away to focus more on the businesses in which they invest, I lose track of new developments in the financing world. As a reminder I’m even trying my hand at playing VC in the background.

But one development that’s been hard to ignore the past two years is the role prominent founders in the logistics technology space have played as investors into other companies. I first flagged this a while back on Twitter (thanks to the lack of a search button, I literally can’t find it buried under the avalanche of my subtweets and test cricket takes). I was curious about whether investors into startups would find it valuable for some of the money they had ostensibly deployed into fast-growing rocket ships to then be redeployed into other companies that they might not have had the inclination to invest in. I touched on it in a comment here to Daniel Stanton (aka Mr. Supply Chain) on LinkedIn a week back.

Bigger picture, there’s still some question in my mind as to how this all works, but let’s try to explore all the dimensions. Funding rounds into logistics startups have gotten larger (and seemingly more frequent) in ‘20-21. All that money, especially at an early stage, can’t simply be thrown into sales and marketing and engineering. The point of a fast-growing technology company is not to hire like crazy, it’s to be more efficient than the rest of the market. So are founders flush with cash finding better ways to deploy that capital? It seems so, and it’s certainly not only happening in the logistics industry. Mid-year the craze was around whether it made sense for startups to invest some part of their rounds into other assets, like cryptocurrency. If that goes against the “burn the boats” mentality that startups are supposed to live by, so be it, the world changes fast.

It’s clear that many founders see investing into other startups as an effective way to make the capital they’ve raised work harder. But that doesn’t fully explain the motivations behind those side investments. Are they being made by the founder/investor as standalone investments (ie, the company has serious promise independent of the founder/investor’s own company); does the investment make sense in conjunction with the founder/investor’s company (ie the startup could be a customer, a partner, or acquisition target of the founder/investor’s company); or is the investment being made, as I noted above on LinkedIn, as part of a new model in VC, a subcontracted investment model, where the overarching VC essentially farms out small-check, early-stage investment to a portfolio company that has a better understanding of the new entrant into its industry.

I mean, it’s hard not to see the Flexport Fund, the most clear and straightforward example of the founder/investor, as some sort of manifestation of this idea…

…in that it might help push Flexport’s growth trajectory nearer to what might have been expected from a company receiving $1 billion in a single go. (As an aside, I cannot help but think of this every time I hear “Flexport Fund.”)

I should add, at this point, that this is much like everything else in logistics and life…it’s not black and white. Founder/investors can have multiple motivations in taking venture capital with one hand and deploying it into other startups with the other. And guessing that since I’ve now gotten somewhat of a handle on this phenomenon, it will immediately become passé and I’ll need to research some other exotic funding mechanism to emerge in ‘22.

A look back and ahead

It’s been beyond gratifying to see people finding value in my weekly newsletter, especially as the last three newsletters of ‘21 have been my most read ones of the entire year. I’ll try to keep the momentum going into ‘22. Looking back, ‘21 was totally consumed by funding rounds and acquisition activity. I parsed our archive of technology stories at JOC.com and was actually amazed by how many rounds happened, and how big the rounds were. Expect more on the horizon. There’s too much cash sloshing around, and supply chain is too prominent a topic right now, for it to slow down anytime soon. I am interested in who might go public in ‘22. A few obvious candidates are out there, but is some other company that’s more under the radar going to either IPO or SPAC itself over the next 12 months? Seems likely that it will happen.

As for what I’ll be watching in ‘22, I’m particularly intrigued by software providers that are what I’ve come to call “minimally invasive.” Like using lasers instead of scalpels in surgery, technologies that automate the in-between gray areas between logistics processes are what will drive the industry forward more than all-encompassing digital transformation projects. It’s a subject I explored in a March ‘21 story that leads this thread on what I consider to be my most important stories of the past year.

Here’s a roundup of recent pieces on JOC.com from my colleagues and myself (note: there is a paywall):

The concept of freight futures in ocean has been tried before, but have the underlying dynamics changed enough to make them more attractive to both shippers/forwarders and container lines? Sky high rates and historic volatility may have tipped the balance, and new benchmark data vendors that didn’t even exist the last time futures were tried are now in the mix.

TradeLens is continuing to grow its network in Asia, building on progress it made mid-year in China by adding Pakistan Customs’ single window initiative to its platform.

I wrote about PayCargo linking with a lending partner to offer shippers and forwarders a way to get instant credit to cope with mounting freight costs. The issue has come to the fore in ‘21 as ancillary charges go far beyond expected costs, putting working capital pressures on freight payers.

And here are some recent discussions, reports, and analysis I found interesting:

I joined Sarah Barnes-Humphrey for a fun year-end wrapup discussion. Thanks as always to Sarah and Let’s Talk Supply Chain for their support of all things LogTech!

Good discussion on using data to mitigate supply chain disruptions here with Josh Brazil of project44, Shabsie Levy of Shifl, and FMC Commissioner Carl Bentzel, moderated by Hariesh Manaadiar of Shipping and Freight Resource.

This is a key sentiment, one I try to convey publicly in my reporting and in my individual discussions with various logistics technology buying entities…

TPMTech Session in Focus:

From now until TPMTech in late February, I’ll be spotlighting a different session at our upcoming event, to be held Feb 24-25 in Long Beach, Calif. This week, I’m looking at a session that may well be the most fun one we have at the event (and not just because it literally leads into happy hour and the network reception that follows). Anyone who follows me knows I see technology aimed at forwarders as the most interesting area I cover these days. And the three panelists for this session are utterly consumed with that space (in Matt Motsick’s case, he’s been consumed with it for two decades now). Can’t wait to dig into it with this crew.

Some upcoming events I’ll be involved in:

The next episode of LogTech Live is Jan. 7, where I’ll be joined by Tobenna Arodiogbu, CEO of trucking software provider CloudTrucks, which is fresh off a massive funding round. We’ll be talking about what that rounds means, the lack of a winner-takes-all in the fragmented world of freight, and also what initially attracted him to the world of trucking. Subscribe here to get alerts and to catch an archive of previous episodes. LogTech Live viewers can use the code LOGTECHLIVE for a 15 percent discount on TPMTech tickets and TPMTech + TPM22 bundles.

The third and final webcast in our Logistic Technology series is Jan. 13, where DCSA CEO Thomas Bagge will join me to discuss how to drive standardization in the global logistics industry. Registration is free.

Disclaimer: This newsletter is in no way affiliated with The Journal of Commerce or IHS Markit, and any opinions are mine only.