Forwarders Aren't Going Anywhere

Welcome to the 94th edition of The LogTech Letter. TLL is a weekly look at the impact technology is having on the world of global and domestic logistics. Last week, I posited that much of the confusion in the logistics, venture, and economic worlds right not is a result of data overload. This week, I’m exploring the extent to which technology can keep mid-market forwarders very much in the game.

As a reminder, this is the place to turn on Fridays for quick reflection on a dynamic, software category, or specific company that’s on my mind. You’ll also find a collection of links to stories, videos and podcasts from me, my colleagues at the Journal of Commerce, and other analysis I find interesting.

For those that don’t know me, I’m Eric Johnson, senior technology editor at the Journal of Commerce and JOC.com. I can be reached at eric.johnson@spglobal.com or on Twitter at @LogTechEric.

Yes that’s a photo of Mark Twain. It will all make sense in a second.

But first, a few screengrabs to get the ball rolling this week.

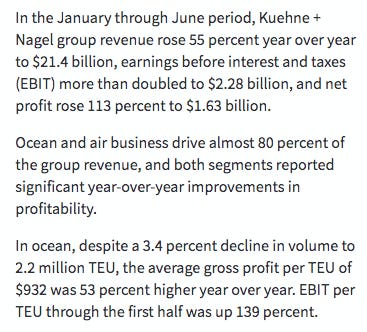

I guess it’s fair to say the demise of the freight forwarder was greatly exaggerated (hence the Twain pic). But these images, of course, represent 1H22 financial results for some of the biggest 3PLs in the world. Maybe the bigger question to ponder is whether mid-size and small forwarders are in such rude health as the those in the top 25. This past week, I was involved in a webcast with ECU Worldwide, the global LCL consolidator, discussing the company’s expansive survey earlier this year about digitization in the forwarding industry.

The survey prodded 800 forwarders of all shapes and sizes for their views on the future of digital booking, where they saw the biggest opportunities for growth, and by how much they expected to grow margin in their business. As it relates to the last question, this slide was telling…

Forwarders evidently have pretty modest profit expansion goals, even in an environment where freight rates have migrated significantly upward. For all the repeated talk about demand easing, rates nosediving and capacity being more plentiful, we’re still at a point where FAK rates are 2-3X what they were pre-pandemic.

I’ve shared this thought exercise of mine with a number of sources recently: What if you took a logistics manager at a shipper and put them in a time machine in Dec. 2019 and dropped them off today? Aside from that person being completely perplexed as to why everyone is constantly talking about this strange COVID word, imagine the person seeing his or her colleagues in procurement high-fiving one another because they landed spot rates at less than $7000/FEU? The person would be wondering how things could have gone so spectacularly wrong.

Now back to what forwarders should do in this environment. I wrote in April about what higher rates meant to forwarder margins:

Forwarders that were able to buy capacity from shipping lines on long-term contracts and then sell that space on the more lucrative spot market generally achieved higher margins, but most 3PLs didn’t have that luxury. Many carriers reduced their annual capacity allocations to NVOs in every size category, often leaving forwarders at the mercy of spot market FAK rates.

And even for those 3PLs that were in a position to expand net revenue in dollar terms or margin percentage, it came at a cost. Multiple forwarders told JOC.com that the cost to manage shipments rose, cutting into any margin expansion.

In addition, many forwarders reported having to essentially win business multiple times, increasing the overall cost to serve a client. For example, a 3PL might respond to a request for quote only to have the shipper choose another provider with a lower rate. But when the second 3PL fails to get the shipper’s container loaded at that lower rate, the shipper is forced to return to the first 3PL, beginning the bid process again.

The ECU survey was largely about the embrace of digitization as a path to more efficiency (ie a reduction in the cost to serve) and revenue growth (ie luring more customers with an online-friendly quoting and shipment management approach). Mid-market forwarders are wrestling with competition from all corners: those top 25 3PLs enjoying historically high profits; liner carriers flush with cash building their own end-to-end service offerings; Amazons building its own LSP footprint; and digital forwarders sucking a lot of the marketing oxygen out of the room.

A focus on digitization seems a required path. From basic data management principles to internal operational efficiency to online customer experience, forwarders in that middle tier cannot rely alone on their offline customer service excellence on both the supply and demand side. The promising thing is that most forwarders are aware of the opportunity, as the ECU survey found. The vast majority see the future of booking as being a digital activity, even if around half still quote via email.

The other promising thing is that there is absolutely no shortage of technology available for the mid-market. What’s more, vendors catering to mid-market players are increasingly partnering with one another, giving forwarders access to multiple tools and data sources through a single investment.

There is still no dominant player in logistics, even if a few brands tend to dominate industry mindshare. The platforms once mooted as tools to wean shippers off their reliance on forwarders are now just as likely to be white-labeled to forwarders. Forwarder member networks are now built around shared and vetted technology applications, not just a database of phone numbers to find an agent in a region not served.

The job of a forwarder is never easy, and there’s maybe never been more competition as now - especially as the market slows and inbound demand from shippers for capacity eases in tandem - but forwarders remain vital precisely because what they do is not easy. If anything, the rise of digital forwarding and Amazon have spurred a renaissance of technology for the mid-market. It’s the era of forwarder enablement, not forwarder disintermediation.

Neal Peart Lyric of the Week:

He’s not concerned with yesterday

He knows constant change is here today

He’s noble enough to know what’s right

But weak enough not to choose it

He’s wise enough to win the world

But fool enough to lose it

Here’s a roundup of recent pieces on JOC.com from my colleagues and myself (note: there is a paywall):

Relevant to this week’s newsletter is also the extent to which shippers manage their balance of insourced or outsourced logistics activities. I explored that topic based on a BuyCo webcast I was involved with earlier in July with Hershey Co., AB InBev and Accenture, as well as some thoughts from other technology vendors and supply chain consultants.

In mid-’21 Flexport struck a well-publicized partnership with Convoy, companies in the international and domestic intermediary landscape that are often compared to one another. Thursday, Flexport added a new US domestic partner, the freight broker Nolan Transportation Group. Flexport Chief Revenue Officer Will Urban said there are likely to be more in the future.

I’ve written in this newsletter before about the significance of freight tracking hardware, especially from the perspective of smart shipping containers. But Tive this week unveiled a product it thinks can be a game-changer due to its cost and size - a shipping label-like sticker that tracks location and temperature for one year. The product is especially suited to perishable and last mile applications, the company said.

And here are some recent discussions, reports, and analysis I found interesting:

Was remiss in not including this in last week’s newsletter, but OECD has put out a must-read report on maritime logistics. One of the co-authors, Olaf Merk, is notably very hard on the carrier and ports sectors, but you cannot fault the amount of work he puts into his research.

You could do worse things with your time than listen to Dan Gardner’s webcast on the new OSRA law that went into effect recently.

Cool infographic on the structure of the container shipping industry that did the rounds this past week.

Gonna keep plugging Dave Ross’ newsletter until you all subscribe.

Not going to be able to make this event this year, due to a conflict with our JOC Inland Distribution Conference in Chicago, but definitely worth your time to attend the VMA international trade event in Norfolk in late September. My good friend Brett Bruen is a keynote.

Had a great time talking about a range of topics, including my process for covering the logistics technology space, with Boris Felgendreher and fellow guest Emma Cosgrove, reported at Business Insider, on the Logistics Tribe podcast.

Some upcoming events I’ll be involved in:

Speaking of Emma, she’s my guest on next week’s LogTech Live. We’ll run down some of the stories she’s done of late, our view on the technology and funding markets, and dig into last mile more than I usually do (because I know very little about last mile!). The best way to keep track of new LTL episodes and updates is to subscribe.

As noted above, our Inland Distribution Conference in Chicago Sept. 26-28 is coming up fast. I’ll be doing a one-on-one with Emerge CEO Andrew Leto and then leading four tech-oriented discussions, including the one on small carrier tech, as well as sessions on LTL tech, freight procurement advances, and venture’s future role in trucking. Don’t miss this - it’s the most substantive surface transportation conference in the market.

Disclaimer: This newsletter is in no way affiliated with The Journal of Commerce or S&P Global, and any opinions are mine only.