Does Logistics Insight Affect Delivery Expectations?

Welcome to the 84th edition of The LogTech Letter. TLL is a weekly look at the impact technology is having on the world of global and domestic logistics. Last week, I highlighted a move to end non-competes in the freight industry. This week, I’m asking a rhetorical question about how logistics professionals themselves view the impact of free and fast shipping.

As a reminder, this is the place to turn on Fridays for quick reflection on a dynamic, software category, or specific company that’s on my mind. You’ll also find a collection of links to stories, videos and podcasts from me, my colleagues at the Journal of Commerce, and other analysis I find interesting.

For those that don’t know me, I’m Eric Johnson, senior technology editor at the Journal of Commerce and JOC.com. I can be reached at eric.johnson@spglobal.com or on Twitter at @LogTechEric.

A month ago, I read this tweet and filed it away as a topic I needed to circle back to, so here we are.

I suppose this is a bookend to an earlier newsletter I pushed out in October about how our insatiable demand for instant everything was putting undue pressure on logistics networks. But that was about us as a society, not about the practitioners who know the inner workings of delivery networks and the upstream supply chains that support them.

To be absolutely clear: I have no idea what the answer to James’ question is (though if you want to get smarter about everything supply chain, I highly recommend you follow him). There’s no data I’m aware of that delineates how logistics professionals view expedited shipping versus the public at large. Our Twitter conversation revolved around our respective interactions with Patagonia related to inventory and delivery timelines.

It’s likely that James and I are at one end of the delivery expectation spectrum, logistics professional* or not (*I’m not a logistics professional, I just play one on Twitter and Substack). By that I mean, we have rational views on what inventory will be available at any given time, and we are not very demanding in terms of the timeline we give a retailer to deliver it to us. Patagonia kinda disappointed us both - see his tweet above about inventory. My experience was that a three-week delivery lead time turned into six, with zero push notifications to alert me of the delay until a few days prior to actual delivery. No big whoop - it’s just a fleece vest (thanks for the gift card, wife!).

But the bigger question he posed is not around general impatience and heightened delivery expectations. It’s about whether the knowledge logistics professionals have access to: that raw materials and components are in short supply, that manufacturing plants may be overrun or out locked down, that origin drayage might be hard to find, that destination ports might be congested, that intermodal networks might be clogged…does that information translate into different demands on delivery networks?

This question really crystallized in my head this week based on two stories I covered (both are described in more detail in the section below): one about warehouse, transportation, and fulfillment provider Stord topping up its coffers with a new $120 million venture round; and the other about fulfillment specialist ShipBob partnering with Flexport to connect ocean freight services.

Both Stord and ShipBob target brands that feel the pressure to not just deliver within two days, but to do so profitably, and to provide those brands an experience that reflects the image the brand wants to portray end-to-end. Those companies are trying to solve the enigmatic problem that brands face: how to make customers happy when customers are fickle and unique when it comes to their ordering and consumption habits. As cash and innovation have flowed into the world of supply chain, a lot of the approaches toward logistics and fulfillment have been funded independently - $40 million to fix drayage, $150 million to build a better freight brokerage, $30 million to harmonize warehouse automation, $25 million to create a last mile delivery network. These were two examples of the messy, but necessary job of joining big freight networks with what needs to be streamlined fulfillment networks.

They’re examples of how a logistics professional might view the home delivery challenge: you can’t provide next-day or two-day delivery if the logistics network hasn’t gotten the product to a place where it can be profitably fulfilled in that timeframe.

My supposition is that the answer to James’ question is that logistics professionals don’t have lower delivery expectations than the general public, even if they know the difficulty in making that happen. Logistics people are only human. But the linkages between international logistics and fulfillment are starting to take shape in a way that it might not matter. That’s important, because even if logistics people do have more rational expectations, there are a whole lot more people outside the industry than inside it.

Here’s a roundup of recent pieces on JOC.com from my colleagues and myself (note: there is a paywall):

As noted above, Stord raised a $120 million round that upped its valuation from $1.1 billion in September to $1.3 billion in March. The round can be seen as a validation of its model, but also as the company preparing itself for the apparent VC winter that’s coming.

On that note, I tweeted an interesting addendum from Stord CEO Sean Henry about why LogTech companies might have more attractiveness in a down market than other VC-backed companies.

The other story I reference, ShipBob’s partnership with Flexport, is an example of how you can see core forwarding services like LCL consolidation and customs clearance as “plug-ins” to ancillary platforms like fulfillment. Especially for shippers that are more familiar with Shopify than they are with Kuehne + Nagel.

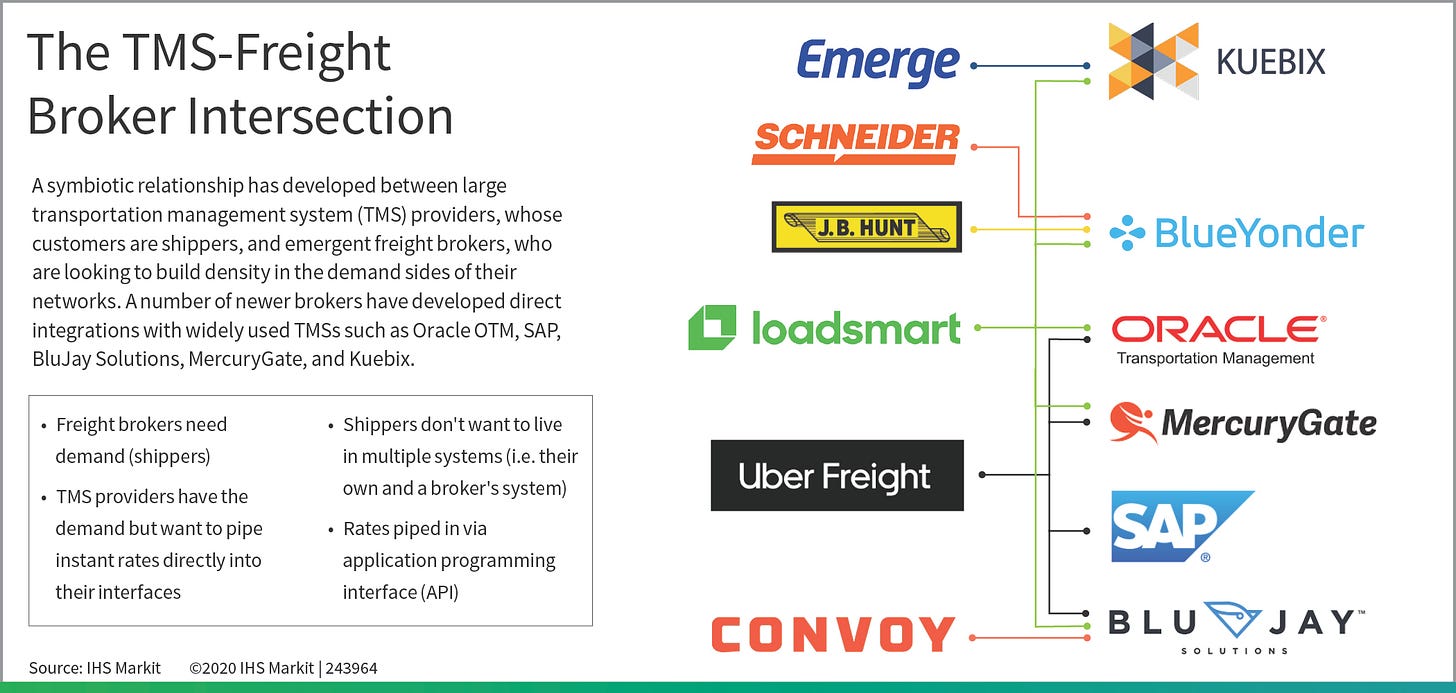

Amazon Freight has built an integration with TMS provider MercuryGate, notable because this was a big trend in 2020 (see the infographic below). The value remains the same and pretty straightforward. Amazon Freight, a truckload broker, gets shippers to channel loads to its carrier network (and into space in its own trailer pool) and MercuryGate gets to put digitally-oriented broker capacity in front of its shipper customers.

Last week, the Global Shipping Business Network (GSBN) said its three-bank advisory committee had helped it develop tools to convey bill of lading information to banks to speed data exchange around letters of credit and open accounts.

Some upcoming events I’ll be involved in:

I’m leading five sessions on digitization in global ports at the IAPH World Ports Conference May 16-19 in Vancouver, including discussions with FMC Commissioner Carl Bentzel, MSC Chief Global Digital and Information Officer Andre Simha, Hamburg Port Authority CEO Jens Meier, Singapore Port Authority CIO Koh Chin Yong, DP World Canada CEO Maksim Mihic, as well as a group of technology vendors. This is going to be a fantastic gathering of the world’s leading ports, terminals and maritime decision makers. Here’s the agenda, and click here to register.

Next week’s guest on LogTech Live (now hitting you twice monthly!) will be Breakthrough’s Heather Mueller, where we’ll discuss data benchmarking in freight, the chaotic logistics market, and the extent to which shipper procurement strategies have shifted the past two years. Subscribe here for alerts about future shows and to see an archive of past episodes.

I’ll be moderating a panel on how the freight industry can gird itself against the threat of cyber attacks at the NITL Virtual Transportation Summit May 24-26. See the full agenda here. Especially pertinent given the Blume incident and another recent attack on Expeditors International earlier this year.

If you’re at Reuters’ Supply Chain Execution conference June 2 in Chicago, come and say hello. I’ll be interviewing Port of Long Beach Executive Director Mario Cordero about the port’s Supply Chain Information Highway initiative.

Disclaimer: This newsletter is in no way affiliated with The Journal of Commerce or S&P Global, and any opinions are mine only.